Core Banking Solutions: The Catalyst for Unlocking Operational Efficiency

Financial institutions face immense pressure to streamline operations and enhance customer experience in today’s rapidly evolving financial landscape. This is particularly true for credit union banking core systems, where agility and efficiency are paramount. Core banking solutions have emerged as the cornerstone for achieving these objectives, providing the technological foundation modern banks and credit unions need to stay competitive.

Understanding Core Banking Solutions

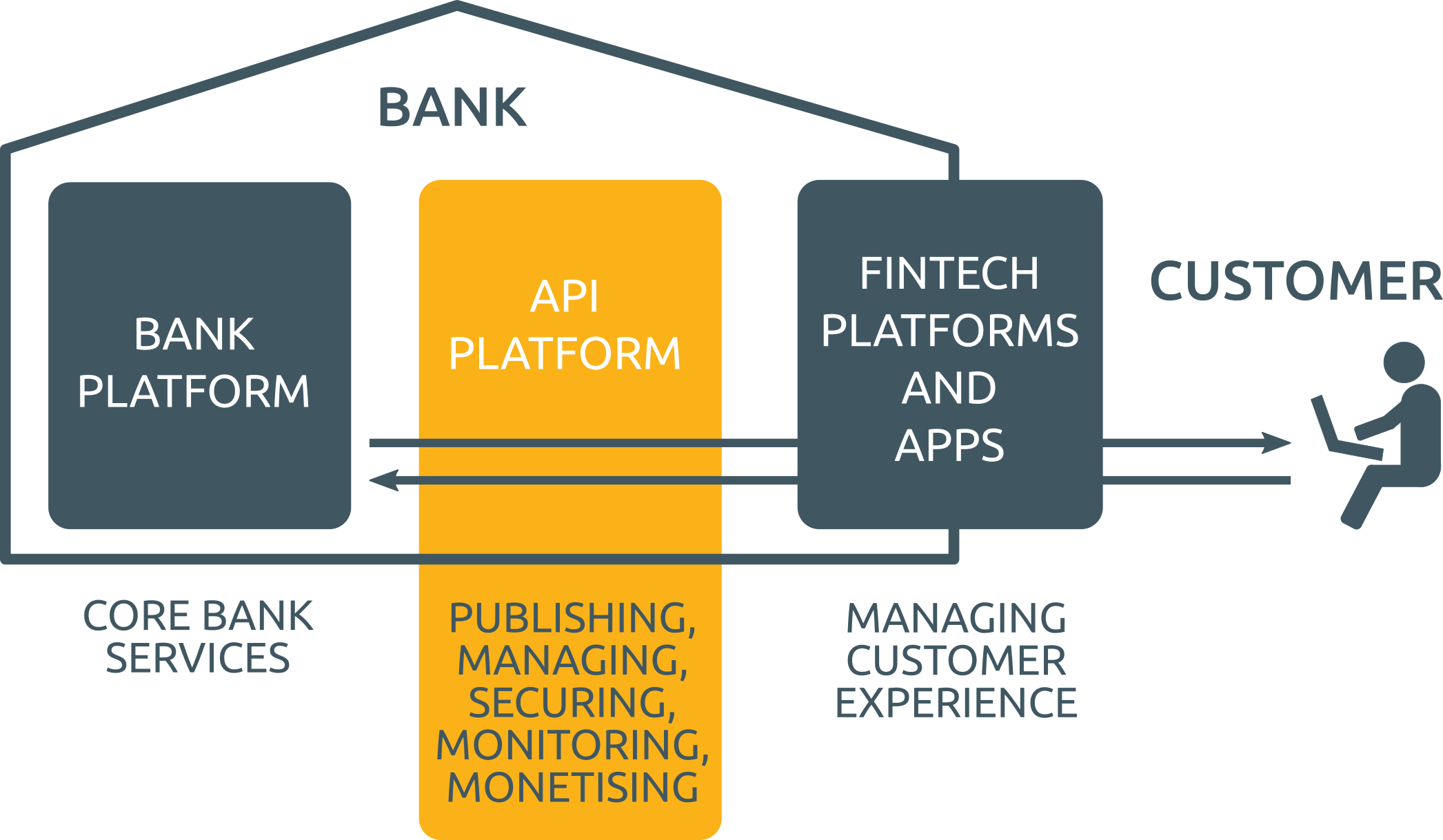

Core banking solutions refer to the central systems and software that manage a bank’s most critical functions, including transaction processing, customer account management, and financial reporting. These systems are designed to provide seamless integration across various banking channels, ensuring that both the institution and its customers can perform transactions smoothly and efficiently.

The Role of Core Banking in Operational Efficiency

Operational efficiency in banking revolves around reducing costs, minimizing errors, and speeding up transaction processing. Core banking solutions are instrumental in this process, offering centralized platforms that eliminate redundant processes and enable automation. This means enhanced service delivery, reduced operational costs, and improved member satisfaction for credit union banking core systems.

Benefits of Modern Core Banking Solutions

- Enhanced Data Management

Modern core banking solutions provide robust data management capabilities, allowing financial institutions to store, retrieve, and analyze vast amounts of data efficiently. This facilitates better decision-making and improves compliance with regulatory requirements.

- Increased Automation

Automation is a key driver of operational efficiency. Core banking systems automate routine tasks such as transaction processing, account updates, and reporting. This reduces the likelihood of human error and frees up staff to focus on more strategic activities.

- Improved Customer Experience

By integrating various banking channels into a single platform, core banking solutions ensure a seamless customer experience. Customers can access their accounts, perform transactions, and receive support across multiple channels without interruption.

- Challenges in Implementing Core Banking Solutions

While the benefits are significant, implementing core banking solutions is not without its challenges. The transition from legacy systems to modern platforms can be complex, requiring substantial investment in time and resources. Additionally, staff must be adequately trained to use the new systems effectively.

Strategies for Successful Implementation

- Comprehensive Planning

A detailed implementation plan is crucial. This includes setting clear objectives, timelines, and milestones. It’s important to conduct a thorough needs assessment to ensure the selected core banking solution aligns with the institution’s goals.

- Stakeholder Engagement

Engaging all stakeholders, including employees, management, and customers, is essential for a smooth transition. Regular communication and training sessions can mitigate resistance to change and ensure everyone is on board with the new system.

- Phased Deployment

A phased approach can reduce risks rather than implementing the core banking solution in one go. Starting with a pilot phase allows the institution to address any issues before a full-scale rollout.

The Future of Core Banking Solutions

As technology continues to evolve, so do core banking solutions. Integrating artificial intelligence (AI) and machine learning (ML) is expected to bring even greater efficiencies. These technologies can enhance predictive analytics, fraud detection, and personalized customer service.

Conclusion

Core banking solutions are indispensable for modern financial institutions aiming to improve operational efficiency. For credit unions, in particular, these systems offer a pathway to more streamlined operations, enhanced member services, and sustained competitive advantage. As the financial landscape continues to evolve, the adoption of advanced core banking solutions will be key to unlocking new levels of efficiency and growth.