Navigating Compliance With Agent Banking Software

Compliance and efficiency are cornerstones of success in the ever-evolving financial services landscape. The need for robust software solutions is paramount, particularly in agent banking, where intermediaries play a crucial role in extending banking services to underserved communities. Enter agent banking software – a powerful tool designed to streamline operations, enhance compliance measures, and minimize errors. This article delves into how such software facilitates efficiency while ensuring adherence to regulatory standards.

1. Understanding the Role of Agent Banking Software

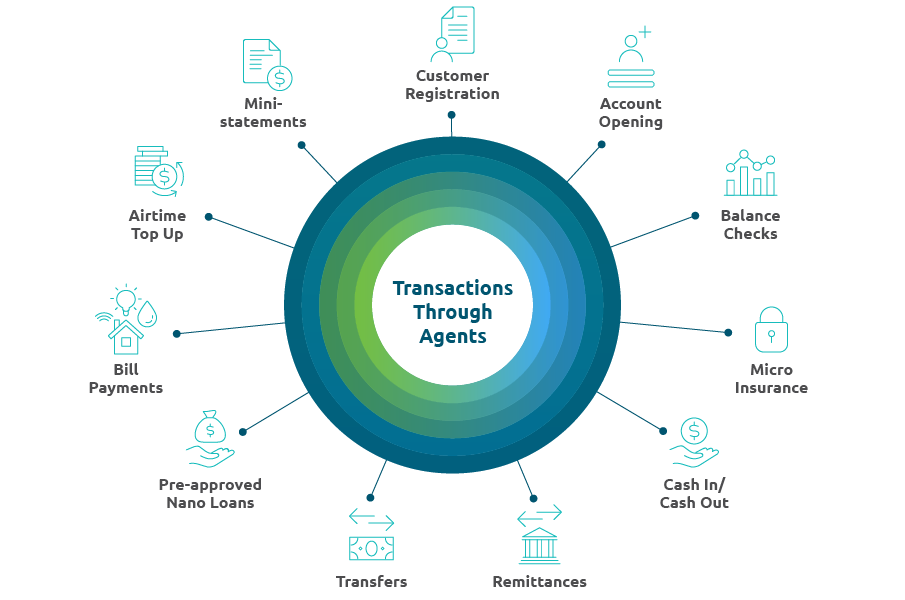

Agent banking software is the backbone of operations for financial institutions engaging in agent banking services. From managing transactions to monitoring agent performance, this software encompasses a wide array of functionalities to optimize the banking experience for agents and customers. Centralizing operations and automating key processes enables institutions to achieve higher levels of efficiency while maintaining compliance with regulatory requirements.

2. Streamlining Transaction Processes

One of the primary benefits of agent banking software is its ability to streamline transaction processes. By providing agents with intuitive interfaces for conducting various banking transactions, such as deposits, withdrawals, and fund transfers, the software minimizes the likelihood of errors and reduces transaction times. This not only enhances the overall customer experience but also increases operational efficiency for participating institutions.

3. Enhancing Compliance Measures

In an increasingly regulated environment, financial institutions’ compliance remains a top priority. Agent banking software plays a pivotal role in this regard by incorporating robust compliance features into its framework. From Know Your Customer (KYC) verification to Anti-Money Laundering (AML) monitoring, the software enables institutions to adhere to regulatory guidelines seamlessly. By automating compliance checks and maintaining comprehensive audit trails, it mitigates the risk of non-compliance and associated penalties.

4. Improving Agent Management

Effective management of agents is critical to the success of any agent banking initiative. Agent banking software empowers institutions to monitor agent performance, track transactions, and provide timely support as needed. Through features such as performance analytics and real-time reporting, institutions can identify areas for improvement and implement targeted interventions to enhance agent productivity. This proactive approach fosters better relationships with agents and contributes to overall operational efficiency.

5. Facilitating Remote Operations

In an era of digital transformation, the ability to conduct banking operations remotely has become increasingly important. Agent banking software enables agents to perform transactions from any location with internet connectivity, reducing reliance on physical branch infrastructure. This not only expands the reach of banking services to remote and underserved areas but also lowers operational costs for financial institutions. By leveraging agent banking software, banks can establish a network of agents in strategic locations, allowing customers to access basic banking services such as deposits, withdrawals, and transfers conveniently.

Moreover, agent banking software facilitates real-time transaction processing and data synchronization, ensuring secure and efficient operations across the network. With the flexibility and scalability offered by agent banking software, banks can adapt to changing customer preferences and market dynamics while driving financial inclusion and expanding their customer base.